With the financial landscape ever-evolving, it’s crucial to stay informed about the various investment options available. One such option that often sparks debate is Treasury Inflation-Protected Securities, or TIPS. These government-issued bonds promise to keep your investment’s purchasing power steady, but are they a smart choice for your portfolio?

Are Tips a Good Investment

In the realm of secure investment options, Treasury Inflation-Protected Securities, or TIPS, frequently garner attention. They feature a unique design to safeguard investors from the adverse effects of inflation. Let’s delve deeper into their concept, their operating mechanism, and their potential benefits for investors.

Treasury Inflation-Protected Securities, commonly known as TIPS, are a type of U.S. Treasury bond. They’re specifically aimed at providing protection against inflation. These securities have their principal tied to the Consumer Price Index (CPI), a government-determined measure that tracks inflation trends. Examples of TIPS include U.S. Treasury bonds of five, ten, and thirty years duration.

How Do TIPS Work?

The functioning of TIPS seems complex at surface level, but it becomes clear when examined closely. The main distinguishing feature revolves around the principal value, which adjusts based on changes in the CPI. For example, if the CPI rises (indicating inflation), the principal value of TIPS increases. Conversely, if CPI falls, it experiences a decrease.

Interest payments for TIPS are contingent on this adjusted principal. Thus, the semi-annual interest payments might rise during inflationary periods, as these payments are a percentage of the increased principal. This two-pronged approach—rising principal value and augmented interest—offers investors a hedge against inflation, which is why many turn to TIPS in volatile economic circumstances.

However, there’s a flip side to this coin. If deflation occurs (i.e., the CPI decreases), TIPS investors could potentially face a reduction in their semi-annual payments, as they’d be calculated from a reduced principal. Nevertheless, at maturity, TIPS will pay the greater of the adjusted principal or the original principal. This safeguard ensures that even in adverse deflationary environments, investors are guaranteed a minimum return.

Comparing TIPS with Other Investments

In the financial universe, Treasury Inflation-Protected Securities (TIPS) earn recognition, alongside other investments such as bonds, stocks, and mutual funds. However, each investment class exhibits distinctive characteristics. TIPS, as previously explained, index their principal to the CPI, promising protection against inflation. On the other hand, traditional bonds involve fixed principal and interest payments, failing to offer inflation protection. Stocks and mutual funds potentially yield higher returns, yet they come with higher risks.

Comparatively, TIPS pose less risk as they guarantee return at maturity and in an inflationary environment, grant increased payments. However, these securities may show lower yields in the absence of inflation.

It’s pivotal to weigh the pros and cons of each investment type. Consider risk tolerance, investment timeframe, and financial objectives when identifying the best-suited investment tools for a well-rounded portfolio. Remember to diversify, since each investment type serves a specific purpose, buffering against different financial scenarios.

How to Invest in TIPS

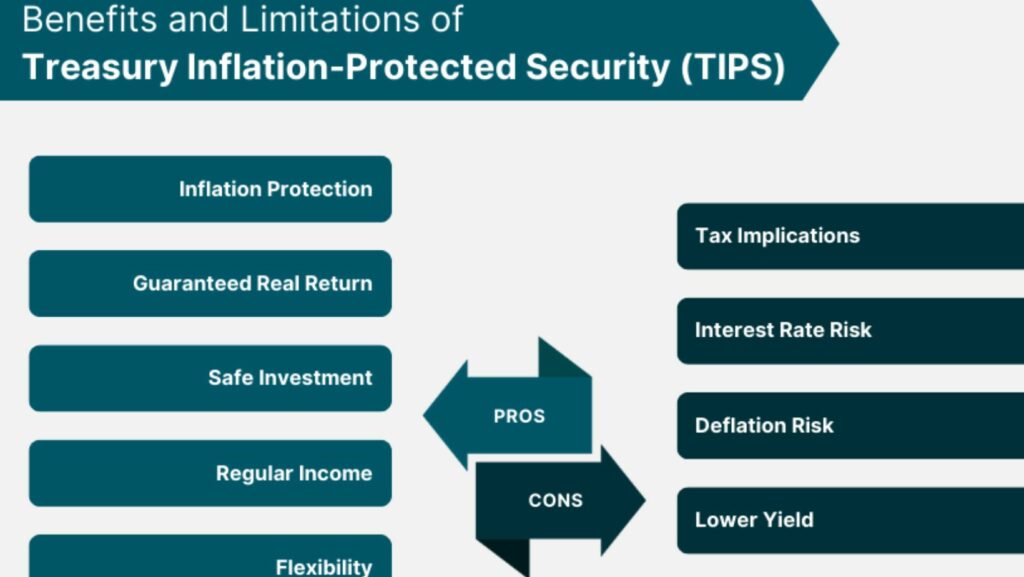

Understanding the dynamics of TIPS is key to incorporating them into a well-rounded investment strategy. They’re a safe haven for those who want to shield their investments from inflation’s sting. With their principal tied to the CPI, TIPS offer enhanced payments during inflationary times. Yet they’re not without risk. In a deflation scenario, payments can decrease. But rest assured, TIPS guarantee a minimum return at maturity.

When compared to traditional bonds, stocks, or mutual funds, TIPS stand out for their inflation protection. But remember, higher potential returns from stocks and mutual funds come with increased risk. It’s all about finding the right balance based on your risk tolerance, investment timeframe, and financial goals. TIPS might just be the missing piece in your diversified portfolio puzzle. In the end, it’s not about choosing one over the other. It’s about creating a mix that’s just right for you.